Proactive Protection: Bagley Risk Management Tips

Proactive Protection: Bagley Risk Management Tips

Blog Article

Just How Animals Threat Security (LRP) Insurance Policy Can Safeguard Your Animals Investment

In the world of animals investments, mitigating threats is extremely important to making certain monetary security and growth. Livestock Threat Security (LRP) insurance coverage stands as a trusted shield versus the uncertain nature of the market, supplying a tactical technique to securing your properties. By delving right into the details of LRP insurance and its diverse advantages, animals producers can fortify their investments with a layer of protection that transcends market variations. As we check out the realm of LRP insurance policy, its function in protecting animals financial investments becomes significantly obvious, guaranteeing a path in the direction of lasting monetary strength in a volatile industry.

Recognizing Livestock Danger Protection (LRP) Insurance

Understanding Animals Danger Security (LRP) Insurance coverage is essential for livestock producers seeking to reduce economic threats related to rate fluctuations. LRP is a government subsidized insurance policy item designed to shield producers against a decrease in market value. By offering protection for market value declines, LRP aids producers lock in a floor rate for their animals, guaranteeing a minimal level of income no matter market fluctuations.

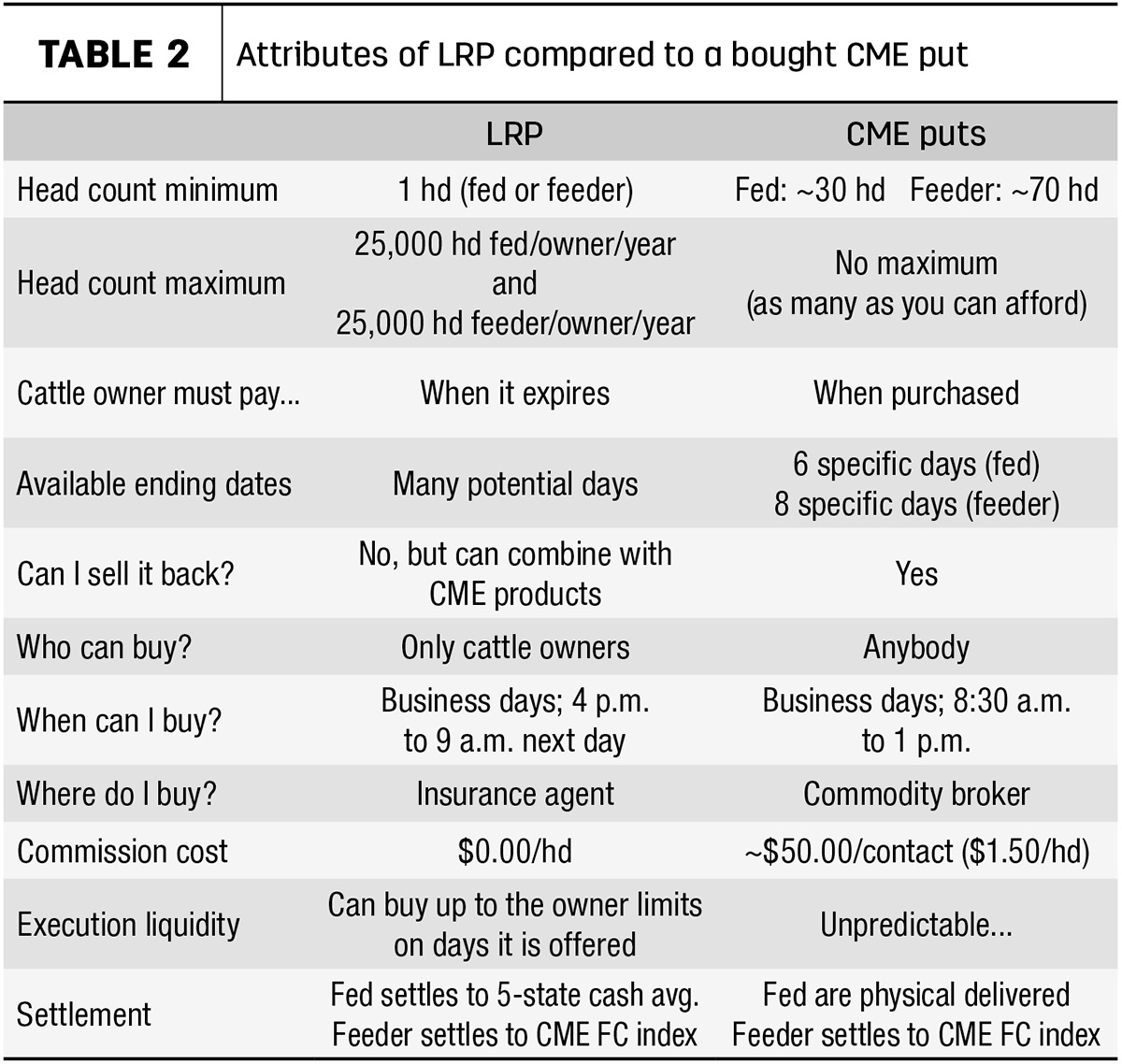

One trick aspect of LRP is its adaptability, allowing producers to personalize coverage degrees and plan lengths to match their particular requirements. Manufacturers can select the variety of head, weight range, coverage cost, and insurance coverage period that line up with their production objectives and risk tolerance. Recognizing these personalized alternatives is important for manufacturers to efficiently manage their price danger exposure.

Additionally, LRP is offered for numerous animals types, including cattle, swine, and lamb, making it a versatile risk management device for livestock manufacturers throughout various sectors. Bagley Risk Management. By familiarizing themselves with the intricacies of LRP, producers can make informed decisions to safeguard their financial investments and guarantee monetary stability despite market unpredictabilities

Benefits of LRP Insurance Coverage for Animals Producers

Animals manufacturers leveraging Animals Risk Protection (LRP) Insurance policy obtain a critical advantage in shielding their investments from price volatility and safeguarding a secure monetary ground amidst market uncertainties. One key benefit of LRP Insurance is price security. By setting a flooring on the price of their livestock, producers can alleviate the risk of significant economic losses in case of market recessions. This permits them to plan their budgets more successfully and make notified decisions concerning their procedures without the consistent concern of price changes.

In Addition, LRP Insurance offers producers with tranquility of mind. Recognizing that their financial investments are guarded versus unanticipated market modifications allows manufacturers to concentrate on various other facets of their service, such as improving animal health and wellness and welfare or enhancing manufacturing procedures. This satisfaction can lead to boosted performance and success in the future, as producers can run with even more self-confidence and stability. Overall, the advantages of LRP Insurance for livestock manufacturers are considerable, offering a beneficial tool for handling danger and guaranteeing monetary protection in an uncertain market environment.

Just How LRP Insurance Policy Mitigates Market Dangers

Reducing market threats, Livestock Danger Protection (LRP) Insurance policy gives animals producers with a trusted guard against price volatility and financial uncertainties. By offering security versus unexpected cost decreases, LRP Insurance assists manufacturers protect their investments and maintain economic stability in the face of market fluctuations. This kind of insurance coverage permits animals producers to secure a rate for their pets at the start of the plan period, making sure a minimal rate degree no matter market adjustments.

Steps to Safeguard Your Livestock Financial Investment With LRP

In the realm of farming danger administration, carrying out Livestock Threat Protection (LRP) Insurance includes a calculated process to safeguard investments against market changes and unpredictabilities. To secure your livestock investment effectively with LRP, the initial action is to analyze the details risks your operation encounters, such as rate volatility or unanticipated weather condition occasions. Next, it is essential to research study and select a credible insurance coverage company that supplies LRP plans tailored to your livestock and organization needs.

Long-Term Financial Security With LRP Insurance

Making sure withstanding financial security with the use of Livestock Threat Security (LRP) Insurance policy is a prudent long-term strategy for agricultural manufacturers. By incorporating LRP Insurance coverage right into their danger management strategies, farmers can safeguard their livestock investments versus unanticipated market variations and unfavorable occasions that can threaten their monetary wellness in time.

One secret advantage of LRP Insurance for long-lasting monetary safety is the comfort it offers. With a reputable insurance plan in area, farmers can alleviate the economic threats connected with unstable market conditions and unforeseen losses because of variables such as illness break outs or natural calamities - Bagley Risk Management. This stability enables producers to focus on the daily operations of their animals service without consistent fret about potential monetary navigate to this website setbacks

Additionally, LRP Insurance coverage offers an organized approach to taking care of risk over the long-term. By establishing certain coverage degrees and choosing suitable recommendation durations, farmers can tailor their insurance policy intends to align with their economic goals and take the chance of tolerance, making sure a sustainable and protected future for their animals procedures. To conclude, buying LRP Insurance coverage is a proactive method for agricultural manufacturers to accomplish lasting monetary security and protect their livelihoods.

Verdict

In verdict, Livestock Risk Defense (LRP) Insurance policy is a valuable device for animals manufacturers to mitigate market risks and safeguard their investments. It is a sensible option for securing livestock financial investments.

Report this page